The RAM market in 2026 is experiencing an unprecedented crisis that has left computer enthusiasts, gamers, and businesses across Bangladesh searching for answers. If you've been waiting for memory prices to drop before upgrading your system, the news from industry experts might disappoint you. Understanding the current RAM price trajectory and what drives these changes is crucial for making informed purchasing decisions in today's volatile market.

The global memory market has witnessed dramatic price increases throughout 2025 and into 2026. What began as a gradual upward trend has transformed into a full-blown supply shortage, with DDR5 RAM price predictions indicating further increases before any stabilization occurs. According to market research firm TrendForce, contract prices for DRAM are expected to surge by approximately 55-60% in Q1 2026 alone compared to the previous quarter.

For consumers in Bangladesh, these global trends translate directly into local retail prices. The RAM price Bangladesh 2026 landscape reflects this international pressure, compounded by currency fluctuations and import dynamics. The Bangladeshi Taka's depreciation against the US Dollar has amplified the impact, with the currency sliding to 118-120 BDT/USD by January 2026, making already expensive imports even costlier for local retailers.

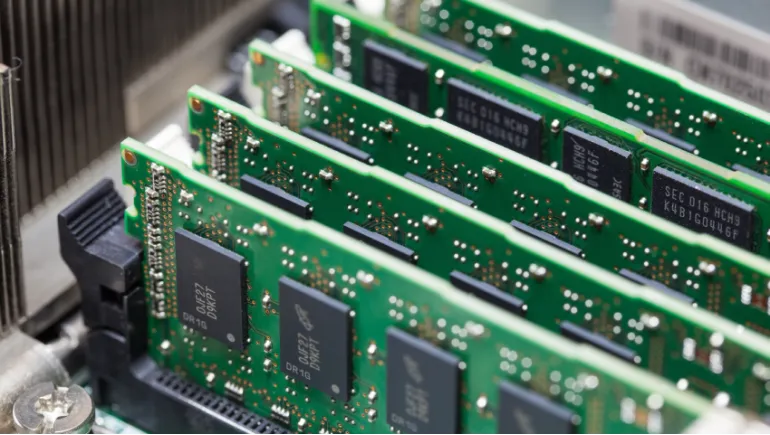

The primary driver behind soaring memory costs is the artificial intelligence boom. Major tech companies including OpenAI, Microsoft, and Google are constructing massive AI data centers that consume enormous quantities of DRAM and High Bandwidth Memory (HBM). This insatiable demand has fundamentally altered manufacturing priorities.

The world's three dominant memory manufacturers, Samsung (43%), SK Hynix (28%), and Micron (23%), control 95% of global RAM production. These companies have strategically redirected their advanced production capacity toward high-margin server and HBM products, creating structural shortages in the consumer market. Industry analysts from IDC confirm this shift represents a low priority assignment for traditional consumer RAM for the first time since the DDR3 era.

Bangladesh faces additional challenges beyond global trends. Approximately 80% of RAM imports arrive via sea routes, which have experienced 4-6 week delays, inflating holding costs for local traders. Customs clearances have slowed amid stricter electronics import scrutiny, further compounding the crisis. Bangladesh's 15% VAT on electronics and 5-10% import duties magnify these price increases significantly.

Industry consensus suggests prices will peak during Q2 2026 before any stabilization begins. Market forecasts predict the supply-demand imbalance will hit maximum intensity during this period, potentially pushing DDR5 32GB kits to 550-600 USD at retail (approximately 66,000-72,000 BDT at current exchange rates).

TrendForce analysts warn that the first half of 2026 will see continued tight supply and rising costs, effectively meaning the shortage worsens before improvement. One analysis bluntly stated that DDR5 pricing "won't return to normal in 2026" and could deteriorate further in the short term as AI mega-buyers continue absorbing most available supply.

The 10-15% RAM drop Q4 2026 prediction represents the most optimistic scenario from current analyst forecasts. This modest decline would come only if several favorable conditions align: successful ramp-up of new fabrication facilities, improved DDR5 yield rate impact from manufacturing efficiency gains, and moderate AI demand growth rather than continued acceleration.

Samsung's Pyeongtaek P4 facility is scheduled to increase DRAM production throughout 2026, and SK Hynix's M15X fab is expected to begin production during the same timeframe. However, it takes several months for new factory output to reach wholesale channels and impact retail pricing. Even with these expansions, significant downward price corrections aren't anticipated until late 2027 at the earliest.

For consumers asking when RAM prices fall, the unfortunate reality is that waiting may prove counterproductive. If you have immediate system requirements, purchasing now rather than delaying until Q2 2026 may actually save money, as prices are virtually guaranteed to be higher during the peak shortage period.

Strategic buyers should consider these timing options:

Looking specifically at the Bangladesh market, several factors will influence local RAM pricing throughout 2026:

The Taka's ongoing depreciation against the US Dollar means that even if global RAM prices stabilize in USD terms, Bangladesh consumers may not experience proportional relief. A 10 USD/GB global DRAM hike translates to approximately 1,200 BDT locally, before adding the 20-30% in duties and VAT.

Retailers like Star Tech BD, Ryans, Ultra Technology, Computer Village, UCC BD, PC House, Sell Tech BD, and other established vendors are navigating unprecedented volatility. Desktop RAM Dhaka sale events may provide temporary relief during festivals like Eid or when new shipments arrive, but sustained price drops remain unlikely through mid-2026.

The DDR5 price Bangladesh market particularly reflects this instability, with prices fluctuating weekly based on import costs, spot market dynamics, and inventory levels. The RAM price Star Tech BD 2026 listings and other major retailer pricing change frequently, making it essential to monitor multiple sources when planning purchases.

-112x63.27.webp)

-132x74.57.webp)

Comments

There are no comments for this Article.