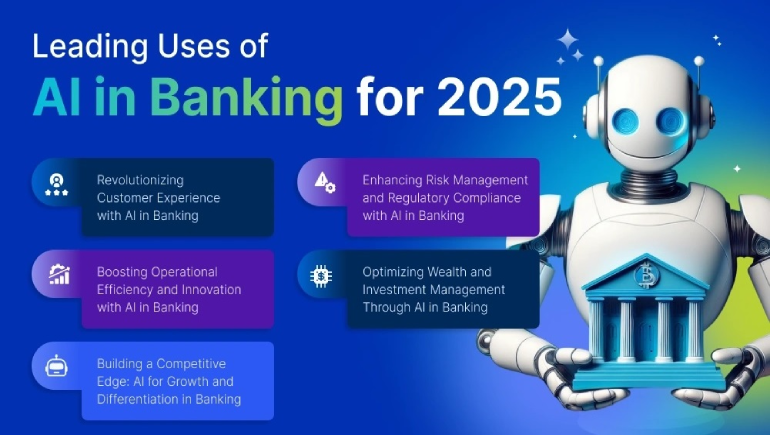

As artificial intelligence continues to reshape industries, the financial sector is undergoing one of its most dramatic transformations. In 2025, fintech startups are not just disrupting traditional banking—they’re outpacing it. By integrating cutting-edge AI technologies, these agile newcomers are redefining the future of banking with unmatched speed, personalization, and efficiency.

Fintech startups in 2025 are leveraging AI not as an add-on, but as the foundation of their business models. From machine learning algorithms that detect fraud in real time to AI-powered chatbots offering 24/7 customer service, startups are offering faster, more intuitive, and more secure financial solutions than ever before.

These companies are capitalizing on their ability to pivot quickly, adopting emerging AI technologies to deliver services that feel personalized and proactive. AI tools analyze user behavior to offer tailored savings plans, credit suggestions, and investment advice—capabilities that legacy banks struggle to implement at scale.

While many traditional banks have invested heavily in digital transformation, their progress has been hampered by outdated infrastructure, regulatory complexities, and bureaucratic decision-making. Integrating AI into legacy systems is both costly and time-consuming. In contrast, fintech startups are born in the cloud, unencumbered by legacy constraints and ready to deploy AI tools at full throttle.

Banks also face challenges with customer engagement. Younger, tech-savvy users prefer fintech apps that are sleek, fast, and intuitive. Traditional institutions still rely on slower service channels, including phone calls, in-person visits, and outdated online portals—creating friction that today’s users won’t tolerate.

1. Personalized Banking Experiences

AI enables fintech apps to deliver banking tailored to each user—something traditional banks still struggle to achieve. Whether it’s analyzing spending habits to suggest budgeting tips or automating investments through robo-advisors, fintech is winning on user experience.

2. Faster Lending Decisions

Through AI-powered credit scoring, fintech lenders are making instant decisions using non-traditional data points like transaction history and digital behavior. Traditional banks, bound by conventional credit models, can take days or weeks to process loan applications.

3. Superior Fraud Detection

Fintech startups use real-time anomaly detection to flag suspicious activities. Their systems continuously learn and adapt, whereas banks often rely on static rule-based systems that are easier to outmaneuver.

4. Customer Support Automation

AI chatbots and voice assistants are becoming the frontlines of customer service for fintech apps. These systems can handle thousands of queries simultaneously, reducing response times dramatically—something traditional banks still rely on human agents to do.

As the gap between fintech and traditional banks widens in 2025, many legacy institutions are reconsidering their stance. Some are forming partnerships with fintechs, while others are acquiring startups to infuse agility into their operations. However, the real winners will be those who can integrate AI deeply and effectively—whether they’re 100 years old or just five.

The regulatory landscape is also evolving to accommodate AI’s growing role in finance. With increasing emphasis on ethical AI and data privacy, both startups and banks must tread carefully. But one thing is clear: AI is not just enhancing banking—it’s redefining who leads it.

-112x63.27.webp)

-132x74.57.webp)

Comments

There are no comments for this Article.